DECENTRALIZED INSURANCE

ABOUT

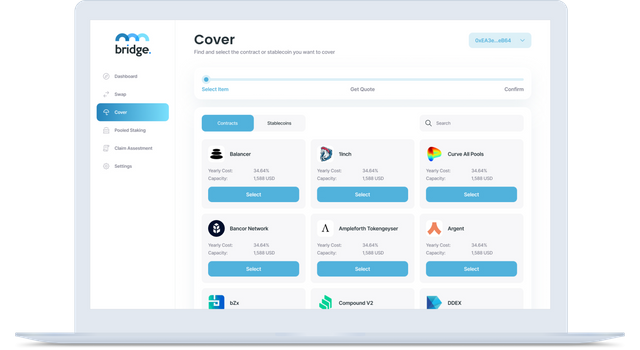

Bridge Mutual provides a decentralized, scalable and comprehensive smart contract system to ensure smart contracts, stablecoins, centralized exchanges and other crypto and DeFi products. It offers a transparent, auditable and on-chain investment strategy to return returns and profit sharing to its users and does not require KYC or personally identifiable information.

This service increases competition by offering to insure stablecoins and exchanges, not just smart contracts. Additionally, Bridge Mutual is built on top of the Polkadot network, which offers forkless on-chain upgrade capabilities and a superior transaction fee structure.

Users can join the Bridge Mutual ecosystem by purchasing BMI tokens and staking BMI on the Bridge coverage pool. Funds in the coverage pool are automatically invested on-chain in other platforms, such as Compound and Aave to generate returns for users. Quotations are generated chained with actuarial formulas; users can connect their Web 3 wallets (Metamask and others) to pay coverage after receiving the offer. A portion of the premium paid by users who purchase coverage is shared among users providing that coverage as an incentive for revenue sharing.

Stablecoin insurance claims are settled instantly. All other claims go through a 3 phase voting process that resolves claims in 6 weeks or less. An incentive system is in place to ensure that every claim is resolved fairly and accurately without fraud or collusion.

This platform does not require any form of identification from its users. All funds in our ecosystem are stored in smart contracts, Bridges are completely non-custodial. No member of the Bridge team has ever had access to the funds staked on the system.

Bridge Mutual has provided legal services for a number of highly visible blockchain projects, including Akropolis, Certik, Kinesis, NOIA, QTUM, FABRK and Gate.io. Bridge Mutual has assembled an outstanding team of insurance and finance experts, as well as other programmers and lawyers. Bridge Mutual aims to be the first platform to provide coverage for the enormous $ 20B stablecoin economy, which is growing at an exponential rate. The project enjoys an over-demand spin of angels and seeds, and is currently in negotiations with a top tier blockchain fund to fill its private spin.

DIFFERENTIAL

Bridge through its decentralized insurance for smart contracts, Stablecoins, exchanges the Bridge offers coverage their users will only need to Choose coins, contracts or exchanges that want you to be safe in this way everyone will be able to bet their IMC token in their pools to provide coverage to customers and in this way everyone will be able to earn passive income over time and share the profits when people buy insurance in a easy and profitable way everyone will have Purchase Coverage when they choose coins, contracts or exchanges for which you want coverage in this way everyone will be able to make a quote and purchase discretionary insurance instantly using the Bridge app in a few clicks so Bridge offers a 24/7 support for all through its decentralized and discretionary insurance application all will be covered by any problems the platform and the Bridge app will be fully decentralized so through its insurance.

application will allow all your users to hold each other in a unique way through from its Transparency the code will be fully transparent being based on Blockchain, so the assessment of claims as the investment of funds will be on-chain and auditable by all audiences in an extremely reliable way in the Bridge All claims will go through a three-phase voting process that in turn will be applied with rewards and punishments, ensuring a complete process for all claims giving

equality to all because Disruptive Bridge can replace the entire traditional insurance industry, transforming the unfair and litigious process by its lack of transparency and misalignment of incentives into a normal and intuitive practice through its solutions because Efficient Bridge will be more efficient than traditional insurers and will not require the work of affiliates , claims specialists or agents in this way, The response time for claims and voting will be predictable and is always less than 6 weeks, regardless of the size of the claim giving greater interest to all parties involved to Bridge will bring innovation to the insurance industry incorporating what best ade of blockchain technology and its solutions

TOKEN UTILITY

- DAO Voting Eligibility

- Access to coverage

- Yields from investments

- Premium profit sharing

- Vote on claims and earn

TOKEN METRICS

- Token Ticker: $BMI

- Token Supply: 160,000,000

- Initial M/Cap: $500,000

- Sale Price: $0.125

- Vesting: 25% per Month

TOKEN ECONOMICS

- 8%: Sales

- 41%: Liquidity

- 16%: Operations

- 6%: Vault

- 17%: Team

- 4%: Community

- 9%: Protection

Roadmap

Q4 2020

Private Sale Development

Q1 2021

Private Sale Development

Q2 2021

$100M Coverage Forecast Bridge DAO Governance

Q3 2021

Product Expansion Capital Pool Growth Coverage Growth

Q4 2021

Main net V2 Traditional Insurance

Team

Mike Miglio: CEO

Josh Vizer: COO

Ian Arden: CTO

Lili Feng: CLO

Hartej Sawhney: CSO

Roman Z: CDO

FOR MORE INFORMATION CLICK LINKS BELLOW:

- Website: https://www.bridgemutual.io/

- Telegram: https://t.me/bridge_mutual

- Medium: https://medium.com/@bridgemutual

- Twitter: https://twitter.com/Bridge_Mutual

Author: Batu permata

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1875984

Tidak ada komentar:

Posting Komentar