nce

LEVERAGED YIELD FARMING BY THE PEOPLE, FOR THE PEOPLE

WHAT IS RABBIT FINANCE?

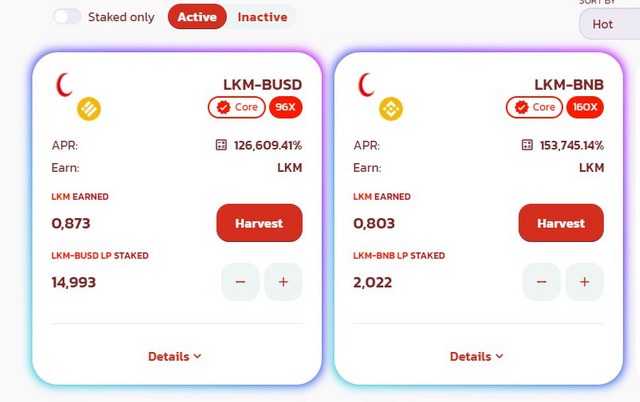

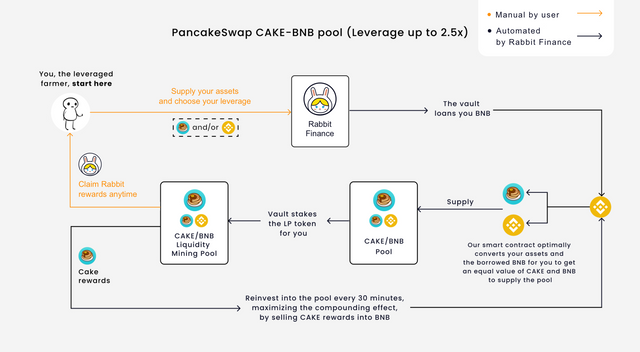

Rabbit Finance is a leverage yield farming protocol built on the Binance Smart Chain. It allows yield farmers to earn a higher returns by opening a leverage position.

Rabbit Finance is a leveraged yield farming protocol based on Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through over-lending plus leverage to get more revenue.

When the user has insufficient funds but wants to participate in Defi liquidity farming, Rabbit Finance can provide up to 10X the leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

The DeFi space is gradually growing, and is making waves in the financial system of the world. Decentralization is now a concept that most businesses and individuals are familiar with, and they have started adopting it in their different ways of living. Centralized financial system is slowly fading away now that individuals have found a better way to go about any financial activity with peace of mind(decentralized finance).

Yield farming is a project under DeFi, and it seems to be one of the best ways for traders to easily generate income for themselves. However, the Decentralized exchanges and lending protocols(which this particular project has) is first in line. Rabbit Finance, a levered yield farming project is also a distributed platform of DeFi, and is here to give users more income when they trade with a higher leverage(10x) on their platform. The platform offers users a 10x leverage, which would result in higher profits for the traders.

10x leverage is a way for traders to trade more than they have. This means that their expected profit will be ten times their invested capital, although, users should note that losses can also be found in any typical DeFi project.

HOW TO MAKE USE OF RABBIT FINANCE AND EARN PROFITS?

Users can either be a lender, a bounty hunter, a liquidator or a farmer. All of these would surely bring in profits for them, no matter what. They have different roles to play in any pool, and different rewards to receive.

STRENGTHS & VISION

Rabbit Finance fully draws on and adopts the advantages of the projects in the market, uses the over-leveraged yield farming products with the advantages of Alpaca Finance and Badger Finance, creatively combines the mechanism of algorithm stable coin to empower the RABBIT token. In the whole economic ecology of Rabbit Finance, the RABBIT token, which is endowed with more application scenarios, not only represents the governance rights and interests of the leveraged yield farming protocol, but also the shareholders’ rights and interests token of algorithm stable coin of RUSD. Whenever RUSD is inflationary, the members who pledge R token to the boardroom will share the additional RUSD as dividends to share the benefits of ecological growth.

Rabbit Finance believes that the levered yield farming platform will be the next killer application in the field of Defi after the decentralized exchange and lending platform. It also believes that algorithm stable coin is the last Holy Grail in the field of Defi. They are and will be the most important infrastructure in the Defi world.

Rabbit Finance’s vision is to become the Federal Reserve of the Defi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and effective financial services at an affordable cost for people of all social strata and groups who need financial services. Rabbit Finance is not a simple leveraged yield farming platform or algorithmic stable coin system. It will be a decentralized and inclusive financial services infrastructure with the ability of continuous hematopoiesis and based on blockchain technology. Compared to being the same role as the Fed, what Rabbit Finance expects goes well beyond The Fed’s role in the world economy.

WHAT IS RABBIT TOKEN?

RABBIT token is a governance token of the Rabbit Finance platform. It will also capture economic benefits of the platform. There will be a maximum of 200 million RABBIT tokens.

The feature and value of Rabbit Finance

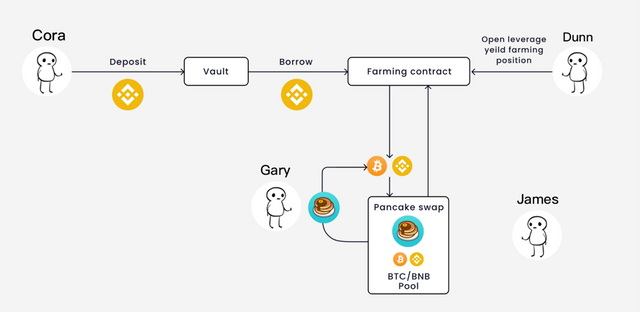

Cora

the lender deposits his BNB into our deposit vault; his asset becomes available for a yield farmer to borrow; he earns interest for providing this liquidity.

Dunn

the yield farmer wants to open a leveraged yield farming position on the BTC/BNB pair; he borrows BNB from the vault and enjoys higher yield farming rewards.

Rabbit

Finance’s smart contract takes care of all the mechanics behind the scenes optimally switching assets to the right ratio, providing liquidity to the pool, and staking LP for Pancake Rewards

Gary

the liquidator monitors the health of each leveraged position, and when it goes beyond designated parameters, she helps liquidate the position, making sure lenders such as do not lose their capital. For this service, she takes a 5% reward from the liquidated position.

James

the bounty hunter monitors the amount of rewards accrued in each pool and helps reinvest it back, compounding returns for all farmers. For this service, he takes 0.4% of the reward pool as a reward. 30% as buyback fund, which will be used for RABBIT’ buyback and deflation. The remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns.

Besides, when the bounty hunter pitches on the pool and executes the reinvestment, 30% of the bounty of the pool is used as buyback funds to promote the value of the token.

Why does reinvestment raise the value of the token? This can be explained by the supply and demand relationship in economics. When the demand exceeding the supply, the value of the asset is bound to raise. According to the deflation mechanism of Rabbit Finance, the 30% of reinvestment earnings is used to repurchase fund to realize the continuous deflation of the token. In the author’ perspective, the deflation mechanism of Rabbit will become the vital factor for realizing the price of token. Continuous buyback and dispose make it possible for the volume of token supply to decline on a limited scale. These will drive the token to be increasingly precious. When Rabbit achieves its implementation, the price of the token is expected to rise correspondingly.

The 30% of the bounty of the pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is directly given to the bounty hunter as a reward, the remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns. The huge power gifted by repeated investment makes it possible for investors to make more profits.

Except for the value increase driven by the token deflation, Rabbit has some other values. For example, before Rabbit coming into being, gun pool tokens can do nothing but to govern. However, Rabbit holders can mortgage their stakes to the board to share bonuses. As long as Rabbit Finance is profitable, its holders are given the right to share the bonus as shareholders and make easy money.

NFT (Non-fungible Token) is an emerging niche market for nearly everyone to take his chance. It is predicted by the specialist that NFT has its potential to become one of the world’s biggest market. The authority of the Rabbit has given much thought to its token. Rabbit Finance Lab will continuously empower Rabbit token, for example, Rabbit holders can snap up irregular issued NFT artwork, and the Rabbit will be automatically locked up during this period. Its circulation will be blocked and its value is expected to be pulled up in a short term. Holding NFT can accelerate mining, empowering the NFT with value with the help of Rabbit.

These two parties are of reciprocal relationships, that is to say, holding Rabbit makes it possible for holders hold NFT, the appreciation of NFT token reacts on the appreciation of Rabbit.

WHAT IS THE RABBIT TOKEN USED FOR?

Protocol Governance

soon launch a governance vault that will allow community members to stake their RABBIT tokens. The RABBIT staker will receive xRABBIT where 1 xRABBIT = 1 vote, allowing them to decide on key governance decisionsIn the initial phase, governance decisions will be made on Snapshot.

Capture Economic Benefits of the Platform

Users of Rabbit Finance Protocol (depositors and borrowers, i.e. lenders and farmers) will be rewarded with RABBIT token for their deposit and borrow behaviors. Rabbit Finance platform will set up a buyback fund with its income, which will be used for deflation and appreciation of RABBIT token. When earnings is reinvested, 30% of that is used to RABBIT repurchase fund. The 20% of the depositor’s interest income is used as market development fund. All of these will contribute to RABBIT’s demand increase and value growth.

Capture Economic Benefits of the RUSD, RBTC, RBNB

RABBIT token is the shareholders’ rights token of algorithm stable coin of RUSD, RBTC, RBNB etc. Whenever RUSD etc. is inflationary, the members who pledge RABBIT token to the boardroom will share the additional RUSD as dividends to share the benefits of ecological growth. For more details, please pay attention to our follow-up announcement.

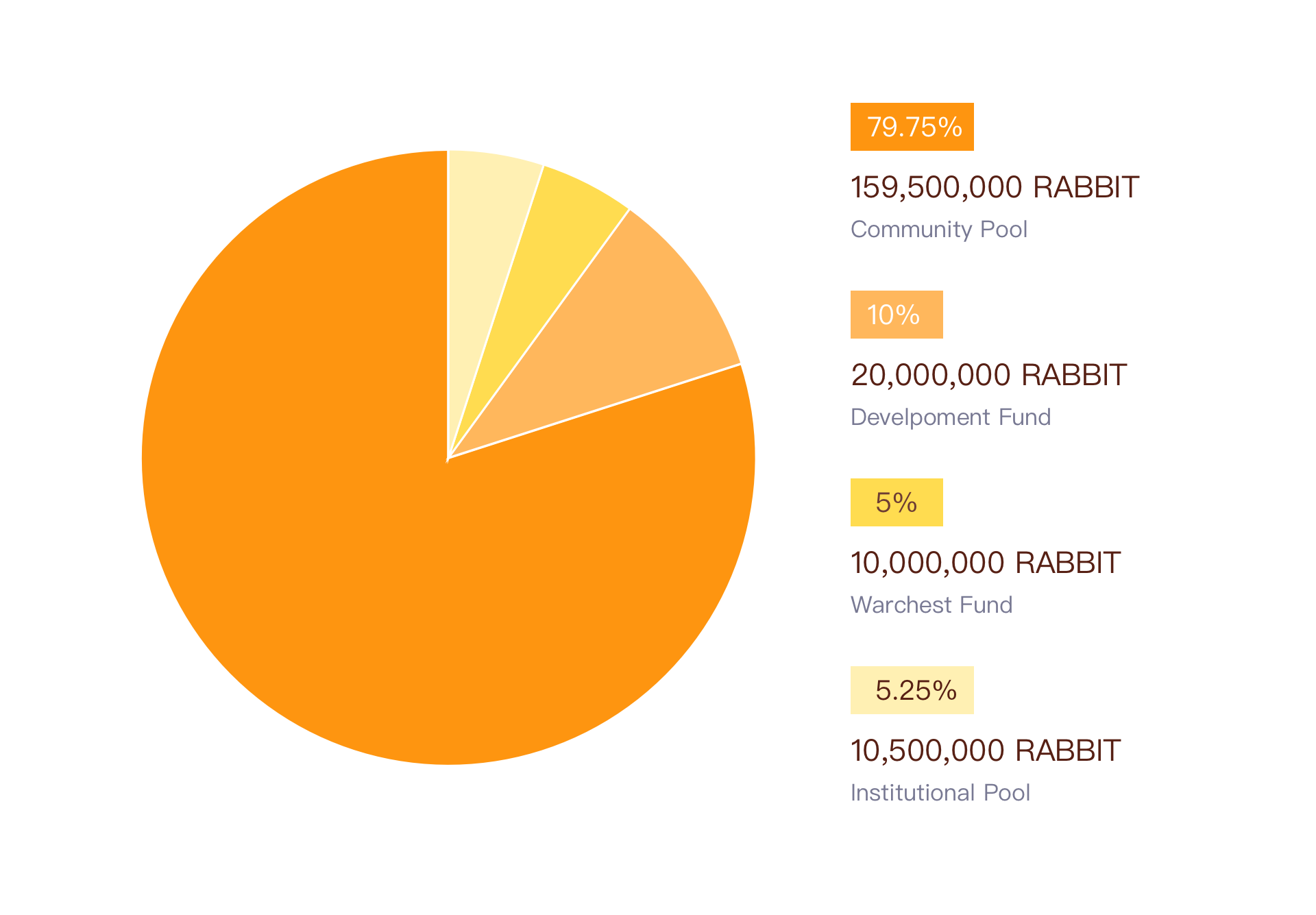

RABBIT DISTRIBUTION

1. Community Pool

79.75% of total supply,about 159,500,000 RABBIT

RABBIT will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

2. Institutional Pool

5.25% of total supply,10,500,000 RABBIT

Provide 5.25% investment quota for well-known institutions and investors. After the completion of the investment, 245,000 RABBIT will be released every 7 days, and 10,500,000 RABBIT will be released within 300 days (about 10 months). Specific time to be determined, please pay attention to the follow-up announcement.

- Hard cap:10,500,000 RABBIT = 525,000 USDT

- Exchange ratio: 1 RABBIT= 0.05 USDT

3. Development Fund

10% of total supply,about 20,000,000 RABBIT

10% of the distributed tokens will go towards funding development and expanding the team, and will be subject to the same two-year vesting as the tokens from the Fair Launch Distribution.

4. Warchest Fund

5% of total supply,about 10,000,000 RABBIT

5% of the distributed tokens is reserved for future strategic expenses. In the first month, 250,000 tokens were released for listing fees, auditing, third-party services, and liquidity of partners.

CONCLUCION

Rabbit Finance fully draws on and adopts the advantages of the projects in the market, uses the over leveraged yield farming products with the advantages of Alpaca Finance and Badger Finance, creatively combines the mechanism of algorithm stable coin to empower the RABBIT token. In the whole economic ecology of Rabbit Finance, RABBIT token, which is endowed with more application scenarios, not only represents the governance rights and interests of the leveraged yield farming protocol, but also the shareholders’ rights and interests token of algorithm stable coin of RUSD.

Rabbit Finance can provide up to 10X leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

FOR MORE INFORMATION CLICK LINKS BELLOW:

- Rabbit Finance website: http://rabbitfinance.io/

- Github: https://github.com/RabbitFinanceProtocol

- Twitter: https://twitter.com/FinanceRabbit

- Telegram: https://t.me/RabbitFinanceEN

- Discord: https://discord.gg/tWdtmzXS

- Contracts info: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

- Audit report: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

Author: Batu permata

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1875984

BSC Wallet Address: 0xB38D41f33bcfB36b083F6AC9078003e5F45f6525