FINTECH COMPANY PRIMARILY FOCUSED ON DELIVERING DECENTRALIZED FINANCE APPLICATIONS WITHIN THE CRYPTOCURRENCY INDUSTRY

WHAT IS CLEVER?

CLEVER is a DEFI (Decentralized Finance) Protocol which distributes AUTOMATIC INTEREST PAYMENTS to all CLVA Token Holders on a pre-programmed routine cycle schedule over 888 fortnightly cycles taking exactly 34.15 years to complete. The CLEVER Token (CLVA) is deployed with verifiable fundamentals to outpace Bitcoin within a validated preset structure reaching a Maximum Supply of One Trillion CLVA over the full 34.15 year cycle period.

Up to 11% Compound interest PAID FORTNIGHTLY with guaranteed automatic payments for all CLVA Token holders Think of CLEVER as the digital smart way to STORE YOUR WEALTH which pays a significantly greater interest rate compared to a now outdated everyday bank account paying little to no interest.

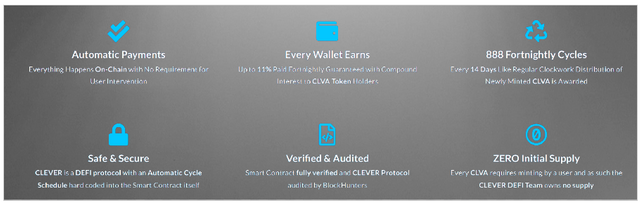

CLEVER FEATURES

Clever will ensure that all participants will get rewards according to their participation. Clever designs an automated payment system that makes everything happen On-Chain with no requirement of user intervention or anything – everything will be processed automatically by the system.

Each wallet will get up to 11% paid fortnightly guaranteed with compound interest, meaning you don’t have to worry about your share, because of Clever guarantees that each token holder will get their share according to their participation. Even with each new 14-day cycle, the system will trigger a decentralized distribution mechanism that will print and deliver CLVA to beneficiaries, which will increase the individual CLVA value and CLVA market capitalization.

Users don’t need to worry about the security and transparency of Clever, because of Clever guarantees that Clever is a safe and secure DeFi protocol with an automatic cycle schedule hardcoded into the smart contract itself. And it is fully verified and audited by BlockHunters, which further ensures that Clever’s DeFi protocols are completely safe and free of manipulation.

HOW IS IT GOING TO WORK?

- It guarantees fortnightly interest payments to all those CLVA token holders each and every cycle period.

- It pays guaranteed and automatic payments. Everything in this system happen on-chain that has no kind of requirements for the intervention of the user.

- It is not possible that some of the CLVA token holders earn and some of them do not. We guarantee that everyone who holds CLVA tokens will make up to 11% interest that is paid fortnightly.

- We offer 888 fortnightly cycles. Like regular clockwork, every 14 days, the distribution of newly minted CLVA is awarded.

- CLEVER is a DEFI protocol that has an automatic schedule of cycles that is hardcoded into the smart contract. So, it is very safe and secure.

- CLEVER is thoroughly verified and audited. This protocol is audited, and Block Hunters fully confirm the smart contract.

- Our team owns no supply because every CLVA token requires minting by its user. So, we don’t have to offer any initial collection.

TOKENOMICS

CLEVER DeFi has well-defined tokenomics that do not promise unrealistic returns for holding its original CLVA tokens. This is important because the DeFi sector is full of projects that have bad tokenomics that hinder the long-term growth of these projects.

CLEVER Decentralized Dynamic Mechanism (DDM) is programmed to generate a total of 1 trillion CLVA tokens over 888 cycles. In addition, the rewards issued by CLEVER’s smart contracts reduce each cycle and are designed to reduce inflation.

CLEVER DeFi also enforces a zero supply rule, and the development team does not own the CLVA token. This is a good measure as there have been cases in the DeFi sector where the founders ordered pre-printed tokens and threw them away after launch which led to falling prices.

Instead of creating tokens beforehand, the CLEVER DeFi team will receive 0.1% of the CLVA tokens printed per cycle. These rewards will be used for development purposes and represent a fraction of the tokens that are printed per cycle.

CLVA TOKEN

- Token Name : CLEVER

- Ticker : CLVA

- Initial Supply : 0

- Maximum Supply : 1 Trillion

CONCLUSION

Clever is a platform that allows you as an investor to be able to buy CLVA tokens and get rewards just by holding them. The solution offered by Clever is quite unique, where token holders can get attractive interest on a pre-programmed routine cycle schedule by only holding CLVA tokens, without contracts, rules, staking, locking, or whatever, token holders are free with their token. The point is that investors can buy as many tokens as possible and get more attractive interest compared to those offered by traditional banks.

FOR MORE INFORMATION CLICK LINKS BELLOW:

- Website: https://clva.com/

- Telegram: https://t.me/cleverdefi

- Facebook: https://www.facebook.com/cleverdefi

- Twitter: https://twitter.com/cleverdefi

Author: Batu permata

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1875984