{HOME LOANS}

Home Loans through Blockchain Technology

HOME LOANS is a platform for investment in loans secured by real estate around the world, built on the basis of the Ethereum platform. Token HlCoin platforms will be provided with the real estate objects and will be traded at crypto exchanges.

HOME LOANS platform uses complex algorithms to predict creditworthiness of all customers and in just 20 minutes a borrower can get their very first the first loan to purchase real estate in his her life just from their smartphone. All customers have an ability to pay less interest and have a higher credit rating, if they use our platform more often.

All aggregated Big Data and Credit Histories are stored on the Blockchain. Thousands of investors have access to millions of new customers that we bring into the world economy and millions of people will have the opportunity to purchase a property anywhere in the world.

Platform HomeLoans started as a company in 2011 to focus on real estate transactions and loans secured by real estate in 2013, aimed at providing optimal solutions to its customers. To improve the professional level in the field of real estate sales and mortgage lending each year, our employees trained, as evidenced by the corresponding certificates. Every year our organization participates in all forums, which take place in the framework of mortgage lending. Our partners such giants as Sberbank, VTB 24, Gazprombank, URALSIB. For programming this platform, we have attracted programmers and experts on smart contracts. Also in the process of developing and running we will attract specialists from the blockchain.

HOME LOANS will be an easily accessible financial platform through which people from all over the world can convert their savings into HLCoin currency supported by a real estate for a potential yield from real estate lending, property purchase and protection their income from inflation. In future we will be able to help all the 1.6 billion people who do not have their own housing, and also all those who, for one reason or another, was refused by banks, adding them to a new global decentralized cryptosystem.

The international lending platform for real estate HOME LOANS provides for such types of loans as:

1. Loans for housing under construction.

2. Loans for secondary housing.

3. Loans for commercial real estate.

4. Loans for land purchase.

5. Loans for own property.

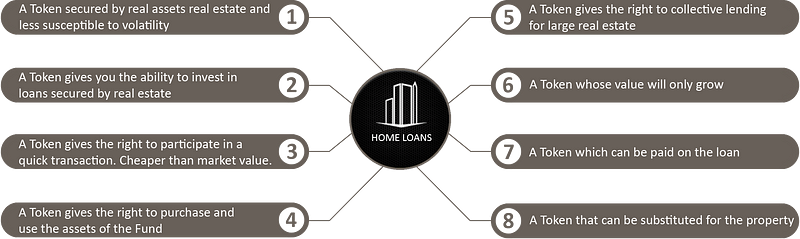

BENEFITS

*HOME LOANS for the crypto community: Creation of a crypto-ecosystem

*HOME LOANS for business: attracting new and returning old customers

*HOME LOANS for people: the opportunity to buy property without resorting to traditional methods like banks

*HOME LOANS for local partners: global business scaling

In order to create a platform HOME LOANS and develop business on a global level, our team took the decision to hold ICO. Successfull ICO will allow us to quickly create products and services, and will also make possible the development in the international market.

COUNTRIES WHERE IT IS COMPLEX TO GET A MORTGAGE

- BulgariaFixed rate: 11%Loan interest: up to 70%Loan term: up to 25 years.

- Czech RepublicFixed rate: 5%Loan interest: up to 60%Loan term: up to 35 years.

- SwitzerlandFixed rate: 4.5%Loan interest: up to 50%Loan term: up to 10 years.

- AustraliaFixed rate: 3.5%Loan interest: up to 60%Loan term: up to 25 years.

- United KingdomFixed rate: 2–4.5%Loan interest: up to 70%Loan term: from 5 years.

The minimum amount of a mortgage loan in Foggy Albion is £100,000, British banks do not prefer to consider applications for less than £ 1 million. Such loans to financial institutions are simply unprofitable. As for the borrower, this situation is not good because the chances of obtaining a mortgage for an economy-class apartment are much lower than if the funds were required to finance an elite facility. Officially, Russians can get a mortgage at an annual rate of 2 to 4.5% and the loan agreement is for five years with the possibility of further extension on revised terms.

COUNTRIES WHERE IT IS IMPOSSIBLE TO OBTAIN A MORTGAGE

- ThailandVery often Asian countries including Thailand (which is popular among investors and Downshifters) give loans only to local residents. This means that in order to obtain a mortgage, a borrower must acquire a residence permit or even a citizenship of the country in advance.

- NetherlandsOne of the requirements for the approval of a loan in the Netherlands is the need to generate income in the EU countries. If the applicant has this privilege then he has chances, otherwise he should rely solely on his own resources.

- NorwayNorway is definitely not the most popular country for foreigners to get a mortgage but if such a desire is still appeared the borrower must prove the income is earned in the territory of the EU.

- ItalyThe situation with mortgages is even more complicated in Italy. It is required not only to open an account with a local bank in advance and actively use it but also to have real estate on the Apennine peninsula or in the Eurozone. Some Italian banks give loans only to citizens with a valid residence permit.

- JapanThere are few banks specializing in issuing loans to foreigners in Japan and in most cases in order to get a mortgage, it is required to have a permanent residence or even citizenship of the country.

Our Solution

A. Creation of an international loan platform by using open-source resources on the basis of block chain technology.

B. Providing private investors with access to large amounts of data.

C. Minimum of 500 000 and maximum of 50 million US dollars.

Original price: the price of the token is fixed at the level of

1 US dollar — 1 HLC token.

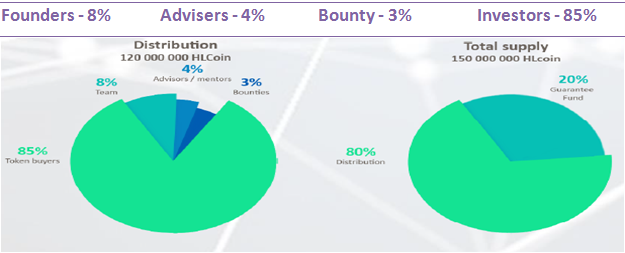

Token Distribution

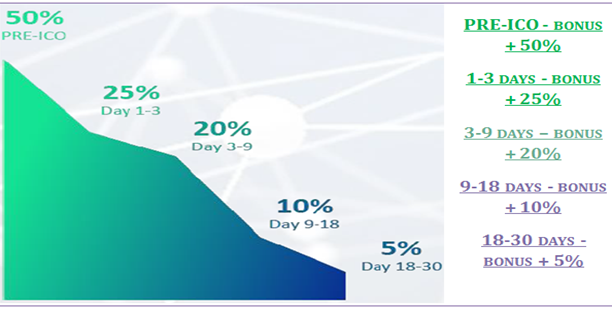

Bonuses to the First Investors during the Initial Offering of the Tokens:

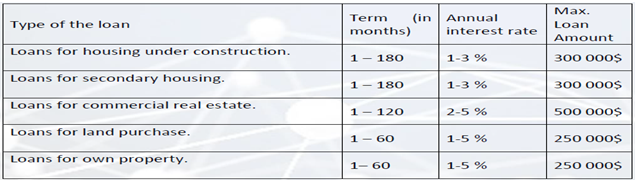

The international lending platform for real estate HOME LOANS provides for such types of loans as:

- Loans for housing under construction.

- Loans for secondary housing.

- Loans for commercial real estate.

- Loans for land purchase.

- Loans for own property.

Table

Age of the borrower is above18 and up to 65 years (at the end of the loan).

Token distribution:

Founders — 8%

Advisers — 4%

Bounty — 3%

Investors — 85%

Bonuses to the first investors during the initial offering of the tokens (additional tokens added to the purchase):

PRE-ICO — bonus + 50% 1–3 days — bonus + 25% 3–9 days — bonus + 20% 9–18 days — bonus + 10% 18–31 days — bonus + 5%

Website: http://home-loans.io/

Facebook: https://www.facebook.com/HLCoin/

Twitter: https://twitter.com/HomeLoansCoin/

Whitepaper: http://home-loans.io/White_Paper_ENG.pdf

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1350925

Tidak ada komentar:

Posting Komentar